Agnico Eagle Announces Additional Investment In Cartier Resources Inc.

TORONTO, March 20, 2025 - Agnico Eagle Mines Ltd. (NYSE: AEM) (TSX: AEM) ("Agnico Eagle") announced today that it has agreed to subscribe for 20,770,000 units ("Units") of Cartier Resources Inc. ("Cartier") in a non-brokered private placement at a price of C$0.13 per Unit for total consideration of C$2,700,100 (the "Private Placement"). Each Unit is comprised of one common share of Cartier (a "Common Share") and one common share purchase warrant of Cartier (each, an "Offering Warrant"). Each Offering Warrant entitles the holder to acquire one Common Share at a price of C$0.18 for a period of five years following the closing date of the Private Placement, subject to acceleration in certain circumstances. Closing is expected to occur on or about April 10, 2025 and is subject to certain conditions.

Agnico Eagle currently owns, or exercises control and direction over, an aggregate of 97,022,944 Common Shares and 7,000,000 Common Share purchase warrants entitling Agnico Eagle to acquire 7,000,000 Common Shares (the "Existing Warrants"), representing approximately 26.6% of the issued and outstanding Common Shares on an undiluted basis and 28.0% of the issued and outstanding Common Shares on a partially-diluted basis (assuming the exercise of the Existing Warrants). On closing of the Private Placement, assuming that 39,432,000 Common Shares are issued by Cartier in connection with the concurrent "best efforts" private placement offering announced by Cartier, Agnico Eagle will own 117,792,944 Common Shares, 20,770,000 Offering Warrants and 7,000,000 Existing Warrants, representing approximately 27.7% of the issued and outstanding Common Shares on an undiluted basis and approximately 32.2% of the Common Shares on a partially-diluted basis (assuming the exercise of the Existing Warrants and Offering Warrants held by Agnico Eagle).

Agnico Eagle and Cartier were party to an amended and restated investor rights agreement dated May 20, 2022 (the "Existing Agnico IRA"), pursuant to which Agnico Eagle was entitled to certain rights (subject to maintaining certain ownership thresholds), including: (a) the right to participate in certain equity financings by Cartier in order to acquire up to a 19.97% ownership interest in Cartier; and (b) the right to nominate one person (and in the case of an increase in the size of the board of directors of Cartier to 10 or more directors, two persons) to the board of directors of Cartier. In addition, Agnico Eagle Abitibi Acquisition Corp. (successor to O3 Mining Inc.), an indirect wholly-owned subsidiary of Agnico Eagle, and Cartier were party to an investor rights agreement dated April 21, 2022 (the "Existing O3 IRA"), pursuant to which Agnico Eagle Abitibi Acquisition Corp. was entitled to certain rights (subject to maintaining certain ownership thresholds), including: (i) the right to participate in certain equity financings by Cartier in order to maintain its then-current ownership interest in Cartier; and (ii) the right to nominate one person to the board of directors of Cartier.

Immediately prior to entering into the subscription agreement in respect of the Private Placement, the Existing O3 IRA was terminated and the Existing Agnico IRA was amended and restated in order to, among other things: (a) increase the ownership interest ceiling in the participation right and top-up right from 19.97% to the greater of Agnico Eagle's pro rata ownership interest in Cartier at the applicable time and 32%; (b) amend the nomination right to permit Agnico Eagle to nominate between one and three individuals to the board of directors of Cartier (based on certain ownership thresholds and the size of the board of directors of Cartier); and (c) grant Agnico Eagle demand registration and piggy-back registration rights in respect of the potential sale of Common Shares by Agnico Eagle.

Agnico Eagle is acquiring the Common Shares and Offering Warrants for investment purposes. Depending on market conditions and other factors, Agnico Eagle may, from time to time, acquire additional Common Shares, common share purchase warrants or other securities of Cartier or dispose of some or all of the Common Shares, Offering Warrants, Existing Warrants or other securities of Cartier it owns at such time.

Agnico ist der einzige der größeren Produzenten die weiterhin kontinuierlich investieren.

Die sollten jetzt mittlerweile an 10-20 juniors/ developern/ explorern beteiligt sein.

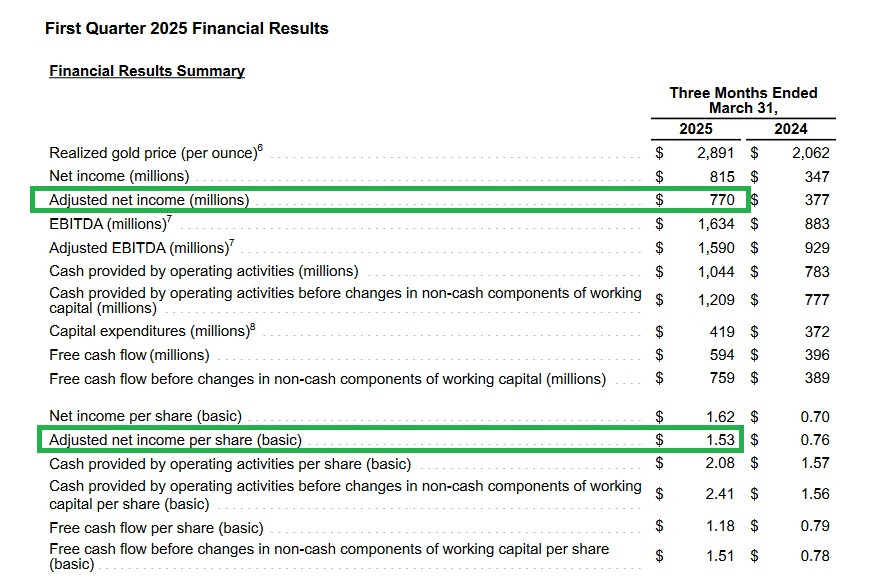

und da zeigt sich mal wieder was ein 1a balance sheet und geringste kosten möglich machen.

man kann das geld für die zukunft nämlich auch sinnvoll ausgeben.